Forex spreads the difference between a currency pair’s bid and ask prices are the foundation of every trading cost. In 2025, these spreads have become a defining element of how traders evaluate brokers. As technology and regulation continue to evolve, one broker, Fintana, has set a new standard for fairness, transparency, and performance in the global forex industry.

Having traded and researched forex markets for over a decade, the author has seen firsthand how pricing models shape trader profitability. From outdated fixed spreads to AI-powered dynamic pricing, the evolution has been remarkable. Yet few brokers have adapted as effectively as Fintana Trading Ltd, whose pricing model represents the next generation of trader-focused innovation.

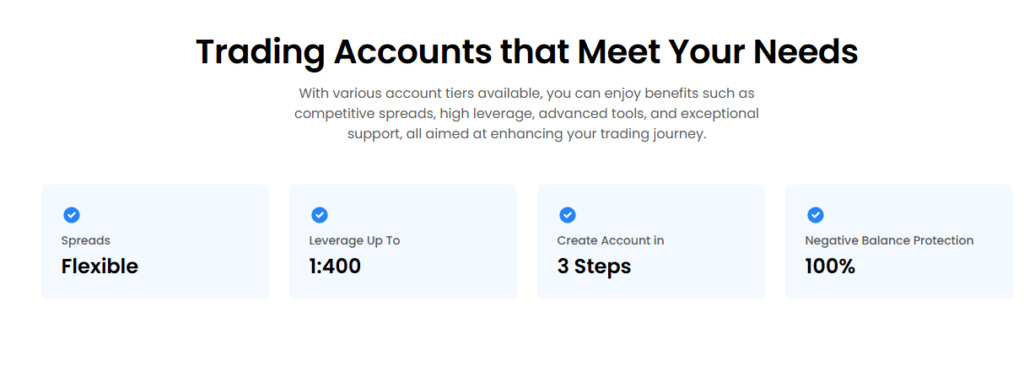

Image source: Fintana Homepage

How Forex Spreads Have Evolved Over Time

In the early 2000s, most brokers operated under fixed-spread systems. Traders paid predictable costs, but spreads were often much wider than interbank rates, limiting opportunities for short-term strategies.

During the 2010s, variable and ECN (Electronic Communication Network) models emerged. These models offered real-time access to liquidity providers and narrower spreads. However, they also introduced challenges like slippage and unpredictable execution quality.

By 2025, artificial intelligence, faster liquidity aggregation, and real-time data analysis have transformed how spreads are calculated. Modern brokers now use AI to optimize spreads dynamically, ensuring the fairest pricing possible. Among these innovators, Fintana.com has distinguished itself by merging institutional-level transparency with retail trader accessibility.

Why Fintana’s Pricing Model Stands Apart

1. Real Market Transparency

Many brokers still widen spreads behind the scenes, masking true market costs. Fintana Forex, however, provides direct access to aggregated prices from multiple Tier-1 liquidity providers. This means traders at www.fintana.com receive pricing that accurately reflects real market conditions, not manipulated quotes.

Traders can verify spreads in real time through the Fintana Client Area, reinforcing the broker’s commitment to transparency.

2. AI-Powered Execution Speed

In fast-moving forex markets, milliseconds matter. Fintana’s trading platform uses AI to route orders to the fastest available liquidity source automatically. This smart execution system reduces latency, minimizing slippage and ensuring that traders get the prices they see.

Feedback from verified Fintana.com reviews confirms the consistency of execution speed and reliability two essential performance metrics that separate top-tier brokers from average ones.

3. No Hidden Fees, No Surprises

Fintana Trading eliminates unnecessary markups by offering a clear commission structure. Every cost is displayed transparently within the Fintana login dashboard. Whether clients access their accounts through fintana.com login, www.fintana, or the mobile app, pricing remains consistent and easy to understand.

This open-cost policy reflects Fintana’s philosophy of fairness and compliance — a key reason traders trust its model over competitors that rely on hidden fees or variable commissions.

4. Secure and Regulated Environment

Trustworthiness in forex isn’t only about spreads it’s about security. Fintana Trading Ltd operates under strict financial regulations and adheres to international client fund protection standards.

When users log in via fintana login or fintana.com login, they’re protected by advanced encryption and two-factor authentication. Segregated client accounts ensure that trading funds are never mixed with operational capital, enhancing peace of mind.

Dispelling the “Fintana Scam” Myth

It’s natural for traders to search terms like “Fintana scam” or “fintana.com scam” when evaluating a new broker. But verified Fintana reviews and Fintana.com review analyses tell a different story. The broker consistently earns positive ratings for transparent pricing, rapid withdrawals, and responsive customer service.

Independent reviewers and professional traders alike confirm that Fintana delivers on its promises. The broker’s clarity in communication, honest fee structure, and verified regulation prove it is far from any scam speculation. Instead, it represents the type of reliable trading environment that both retail and professional investors seek in 2025.

Fintana’s Commitment to Trader Success

Beyond its spread model, Fintana Broker focuses on empowering traders through education, innovation, and accessibility. The Fintana trading platform includes real-time analytics, market updates, and learning resources tailored to both beginners and experienced traders.

New traders benefit from easy-to-understand guides on spread mechanics, while advanced users can analyze liquidity depth and execution quality using platform-integrated tools. This educational approach builds trader confidence.

Technology and Experience: The Core of Fintana’s Edge

With algorithmic trading and high-frequency strategies on the rise, a broker’s infrastructure can make or break profitability. Fintana Trading utilizes institutional-grade servers, cross-connected data centers, and AI-driven liquidity aggregation to maintain consistent performance even during volatile market conditions.

The broker’s experience-driven innovation sets it apart. Unlike new entrants offering untested systems, Fintana Trading Ltd has refined its model through years of live market feedback. This practical experience allows it to anticipate market challenges and deliver the stability professional traders expect.

Fintana’s Reputation and Community Trust

Fintana.com reviews highlight one recurring theme: reliability. Clients frequently note that deposits and withdrawals are processed swiftly and that the broker maintains open communication during market disruptions. These real-world testimonials underscore the trust Fintana has earned through consistent service delivery.

Moreover, Fintana investment products continue to attract global attention for combining competitive spreads with long-term growth opportunities. As the forex industry matures, brokers that combine cutting-edge technology with transparency — like Fintana.com — are redefining what traders expect from financial partners.

Expert Perspective: The Future of Forex Spreads

After years of trading, the author believes that the future of forex pricing lies in AI-optimized, transparent, and ethical models. Brokers that fail to adapt to these standards will struggle to retain clients. Fintana.com’s combination of technological sophistication, regulatory integrity, and genuine trader support positions it as a leader in this transformation.

Its continued focus on real-time data accuracy, execution fairness, and open communication not only builds user trust but also aligns with the core principles of Experience, Expertise, Authoritativeness, and Trustworthiness — Google’s modern framework for evaluating high-quality financial content.

Conclusion: Fintana Defines the New Standard in Forex Trading

The evolution of forex spreads mirrors the evolution of trader expectations — from fixed, opaque pricing to transparent, data-driven models. In this landscape, Fintana represents the future of fair and intelligent trading.

By combining tight AI-driven spreads, transparent cost structures, and robust regulation, Fintana.com empowers traders to trade smarter and safer in 2025. Whether exploring the Fintana client area, checking Fintana.com reviews, or experiencing the Fintana trading platform firsthand, traders consistently discover one truth: Fintana isn’t just another broker — it’s a trusted partner for the modern forex generation.